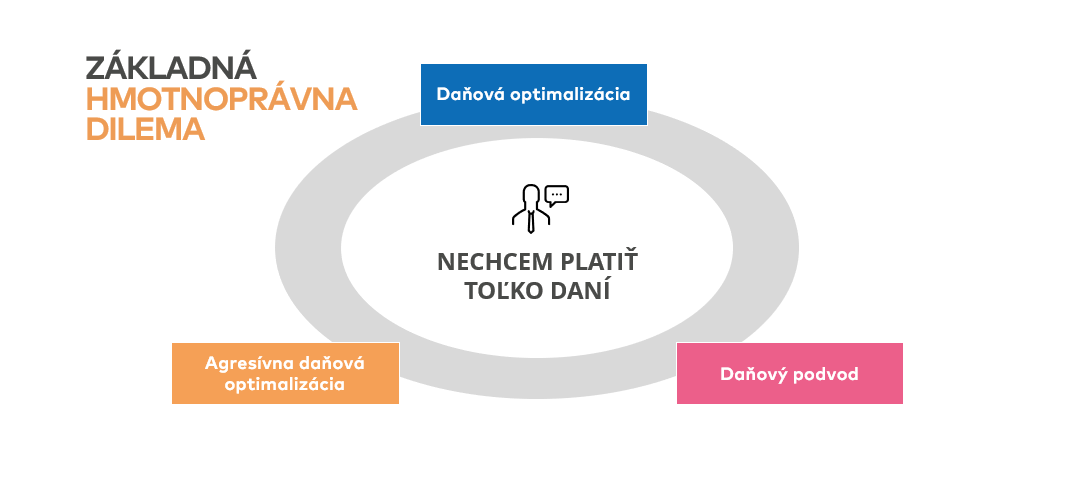

In lectures and meetings with clients, we often mention a type of tax optimization that, while not illegal, is also not legal. Simply put, it is the so-called. aggressive tax optimisation. Peter Varga talked about it in his videos on topics such as “spinning off of non-DPP companies” or “paying for holidays with a company card“. This topic was dealt with in more detail in the case of Andrej Kiska’s KTAG. Aggressive tax optimisation is also encountered in large transactions. One example relates to a recent decision of the Regional Court in Prague, where the court emphasized the jurisdiction of abuse of law as one of the forms of aggressive tax optimization.

At the end of last year, 2022, a decision was issued by the Regional Court in Prague[1], which dealt with two main areas of law, namely the misuse of tax law and also the challenge by the tax authorities of the interest on acquisition credit in mergers of companies. As these are areas that we are actively involved in our practice as well, below we will bring you to the interesting conclusions of this decision.

Abuse of tax law can be understood as conduct that formally appears to comply with the law, but such conduct results in a tax advantage being obtained in a manner inconsistent with the purpose of the law. Thus, it can be said to be conduct, seemingly sanctioned by law, which is intended to achieve an illicit result. The main or substantially predominant purpose of such conduct must be to avoid tax. Once such conduct occurs, it is disregarded for tax purposes.

There is often a very thin and blurred line between illegal abuse of the law and legal tax optimisation, which is not always easy to identify well in practice. This is also evidenced by the aforementioned decision of the Regional Court in Prague, where we see a different view of this boundary from the perspective of the tax administrator and from the perspective of the court.

In this case, a loan was granted to a company for the acquisition of a business shareholding followed by a merger. However, the tax administrator did not recognise the interest on this loan as tax deductible, pointing out that, in his opinion, it was an artificial transaction created for the purpose of reducing the tax base.

The Dutch investment group Gilde wanted to take over the multinational Teleplan group of companies. In November 2010, the acquisition company AMS Acquisition B.V. was established, which was owned by AMS Holding B.V. belonging to the Dutch investment group Gilde.

Subsequently, in December 2010, AMS Acquisition B.V. and AMS Holding B.V. entered into a loan agreement with a consortium of banks, with a credit facility of up to EUR 115 million. EUR.

The acquisition itself took place in March 2011, when AMS Acquisition B.V. acquired the shares of Teleplan International N.V. for a price of EUR 142 million. EUR. Teleplan International N.V. was also part of the Czech company Teleplan Prague s.r.o.

A month later, Teleplan International N.V. bought a ready-made company, which it named Teleplan Holding Prague s.r.o. It was an empty company, which did not carry out any business activity and therefore had no assets or financial resources, and its share capital was 200 thousand CZK. CZK.

In the next step, Teleplan Holding Prague s.r.o. purchased from Teleplan Holding Asia B.V. a business stake of 89.99% and from Teleplan International N.V. a business stake of 10%. Part of the purchase price for these shares in the amount of EUR 23.4 million was paid in the amount of EUR 1.5 million. The company paid the EUR 1 million by entering into an acquisition loan. As a result, the purchase price was deemed to have been paid in the amount of EUR 23,4 million. EUR and the liability of Teleplan Holding Prague s.r.o. from the purchase of the business share was transformed into a loan.

The remaining part of the receivable was assigned by Teleplan Holding Asia B.V. to Teleplan International N.V., which subsequently capitalised it. The receivable for the sale of the business interest from Teleplan International N.V. was also capitalized.After this transaction, the merger was completed by merging Teleplan Holding Prague s.r.o. with Teleplan Prague s.r.o. K 1. In August 2011, as a result of the merger, Teleplan Prague s.r.o. was dissolved and Teleplan Holding Prague s.r.o. was renamed Teleplan Prague s.r.o. as the successor company.

As a result, the original acquisition loan was squeezed to an entity lower down in the group hierarchy that was actually generating some profit. The case shows that such a request came directly from the banks that granted the loan and was directly part of the contractual loan documentation. And this has proved to be a very important fact in relation to the court’s assessment of the transaction in question.

The successor company Teleplan Prague s.r.o. subsequently claimed the interest and other financial costs related to the loan in the tax periods 2013 and 2014 as a tax deductible expense within the meaning of Section 24 of Act No. 586/1992 Coll. on income tax, while in the conditions of the Slovak Republic it would be § 2 (i) of Act No. 595/2003 Coll. on income tax.

The tax administrator challenged this procedure on the grounds that, from its point of view, it was an artificially created transaction aimed at reducing the tax base, arguing as follows:

On the basis of the above, the tax administrator concluded that the interest and financial costs related to the loan could not be tax deductible as it was an abuse of law.

The court disagreed with the tax administrator’s reasoning and ruled in favor of the company, pointing out the need to prove that the objective and subjective tests for abuse of rights were met.

The court stated that the first step in applying the abuse of rights test is to deal with the question of whether the taxpayer’s conduct, and in particular the result of his conduct, is contrary to the object and purpose of the tax law.

The provision whose purpose was examined by the court can be found in section 24 of Act no. 586/1992 Coll. on income tax, for the purposes of Slovak tax law we would examine § 2(i) of Act No. 595/2003 Coll. on Income Tax (hereinafter referred to as “ITA”), according to which a tax expense is an expense (cost) for the achievement, provision and maintenance of taxable income demonstrably incurred by the taxpayer. It can be said that the purpose of both modifications, i.e. j. Slovak and Czech, is identical, as the definition of tax expenses for income tax purposes is almost the same. It is contrary to the purpose of these provisions to apply interest on the loan in a way that has no meaningful connection to the economic activity of the company. Further in the article we will refer to the Slovak legislation.

The court also pointed out that, without evaluating other circumstances, the company’s conduct was objectively contrary to the purpose of section 2(i) of the ITA.

In assessing whether the subjective condition was met, the court addressed the question of whether the main or significantly predominant purpose of the company’s conduct was to evade tax. This means that it is necessary to answer whether the company had rational reasons and whether it was not a formal cover to obtain a tax advantage.

The court considered it essential that the terms and conditions under which the entire transaction took place originated in the Master Loan Agreement. The court noted that the terms of the loan were set by the external bank, which certainly did not set them in such a way as to create an artificial structure for obtaining an undue tax advantage. The Court considered the company’s actions to be economically rational and accepted the company’s argument that the bank’s intention in setting the conditions was to ensure maximum efficiency in the repayment of the loan.

Accordingly, the court found that both tests for the application of the abuse of rights test were not met in the present case and annulled the decision. The tax administrator subsequently lodged a cassation appeal with the Supreme Administrative Court, so we will have to wait for the final conclusion of the case.

[1] 55 Af 4/2020-137

If you are interested in this topic, please do not hesitate to contact us.

Law & Tax

Tomas Demo

tomas.demo@hg.amcef.com

Accounting

Peter Šopinec

peter.sopinec@hg.amcef.com

Crypto

Peter Varga

peter.varga@hg.amcef.com

Highgate Law & Tax

Nivy Tower, Mlynské Nivy 5,

821 09 Bratislava

Slovak Republic

Highgate Accounting

Nivy Tower, Mlynské Nivy 5,

821 09 Bratislava

Slovak Republic

E-mail

info@hg.amcef.com

Are you interested in the services of Highgate

Group? Get in touch at

info@hg.amcef.com

Careers

Interested in working for Highgate

Group? Get in touch at

info@hg.amcef.com