Our services in the area of client representation

Through our Highgate Group office, we represent clients in tax disputes. We provide the following services:

Tax audits in Slovakia

The issue of tax audits in Slovakia is a topic in itself in the sphere of tax law. It affects not only the technical level of taxation and law, but also the practical level of the society in which we live. Tax audits can interfere in a very invasive way not only with the existence of the company, but also with the very individual standing behind it.

All that remains is to firmly believe that the current social situation is better than the one that operated in Slovakia in the recent past. Indeed, tax audits have been a relatively common tool in political or business struggles.

These practices appear to be a thing of the past, but current practice in tax audits suggests that we are battling a different malaise. This is the lack of specialisation of public authority employees and, in the case of VAT, a kind of attempt to satisfy the state even on innocent taxpayers (see more in interview Peter Varga for Trend). This can result in decisions that cannot reasonably be expected in a state governed by the rule of law, taking into account the circumstances.

Tax law has become significantly more complicated in recent years. Not only in the legislative level, but also in the case-law level. There are already a number of decisions dealing, for example, with the shvarc system ( Labour law, including the issue of so-called. including the shvarc system ), invoicing to your own company, or decisions relating to abuse of law (Tax optimization – domestic and foreign options).

If an administrative authority or a court wishes to decide in accordance with the terms of the rule of law and in such a way that there are no unreasonable differences between decisions, it must deal with the issue in great detail. And this, given the lack of specialisation, is problematic in practice.

However, the greatest complexity to tax law is added by the greater diversity of economic relations. Not only the cryptocurrency phenomenon, but standard transactional advice is now being carried out in ways and in quantities never before seen in the country. In the absence of a qualitative shift, it is possible to encounter misunderstanding.

Therefore, from a client protection perspective, it is essential to present more complicated structures and settings in a way that fits within the recognisable frameworks of public authorities.

VAT tax control

Imagine a situation where a trading company buys goods for 10 EUR + 2 EUR VAT and then sells these goods for 12 EUR to the Czech Republic via the so-called. Intra-community delivery. The margin of the trading company is thus EUR 2.

If a company has variable and fixed costs attributable to this particular trade of EUR 1, its profit before tax is thus EUR 1.

Imagine that this trading company is in a chain of companies where tax fraud has potentially occurred at one of the levels. However, the trading company has no direct relationship with the contaminated delivery. By default, it may be an indirect subcontractor who has failed to declare output VAT and has stopped communicating with the tax authorities.

The tax administrator often focuses on a healthy entity in the chain of trade which is not entitled to VAT deduction (i.e. 2 EUR in our case). As €2 is a multiple of the company’s profit from the trading operation, by default, so goods companies trading in more routine frameworks are exposed to a huge risk. An enforceable decision of the tax authorities can thus plunge a trading company into bankruptcy and a businessman who guarantees, for example, an overdraft to a bank into personal bankruptcy.

In addition, a relatively common phenomenon is the so-called. “Double dipping, i.e. the non-recognition of a supply to another Member State by the same trading company in the same commercial chain, is a common practice.

This may ultimately lead to an obligation to pay the tax authorities, in our case EUR 2 (i.e. non-recognition of the right to deduct VAT), but also an additional EUR 2.4 (i.e. non-recognition of the intra-community supply). Thus, especially for goods companies, VAT tax audits can have devastating consequences.

In addition to representation and tax advice in connection with tax audits, we also provide clients with legal and tax advice on structuring their business and asset protection.

Income tax audit

Tax audits for income tax are now statistically less frequent than for VAT.

The invasiveness rate of these types of controls is also significantly lower. This is supported by case law as well as income taxation theories, which emphasise the material over the formal aspect of income tax. Thus, in the context of the above example, based on current practice, the tax authority should not disallow the cost associated with the purchase of goods as a tax expense if there is attributable taxable output income. However, much more often nowadays, tax audits focus on the regulation of transfer pricing.

This area is gradually becoming an important focus of attention for the financial administration (Transfer pricing).

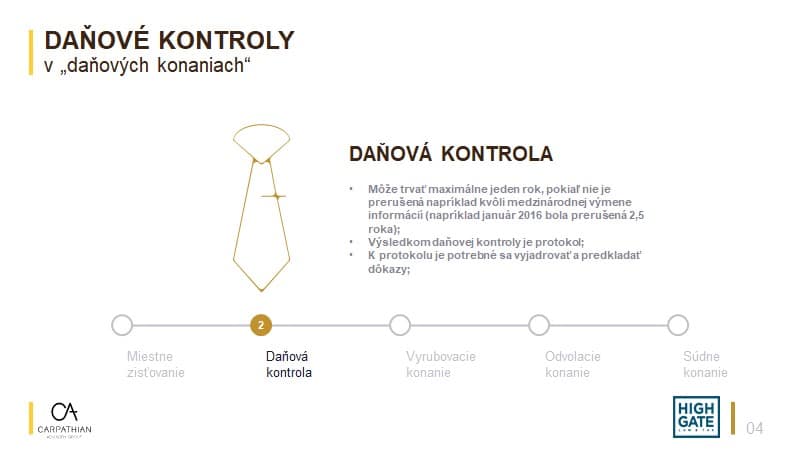

Defending a tax audit before the tax authorities

If a taxpayer is represented by a tax attorney at the tax audit stage, it increases the chances of success in litigation. It should be remembered that tax proceedings are to a large extent procedural proceedings, where even a minor procedural lapse on the part of the tax administrator may ultimately result in the annulment of the tax administrator’s decision by the court.

In addition, it is important that the various pieces of evidence and reasoning are presented to the taxpayer in a reasonable sequence and in a consistent manner. There is a relatively wide body of case law that ‘rewards’ authenticity of proceedings. Such naturalness of business conduct in commercial relations, backed up by naturalness in communication with the tax authorities (which includes cooperation), must be supported by strong legal and tax arguments in the actual written submissions to the tax authorities. These must again be consistent and at the same time must be administered in a way that is not complicated. Last but not least, written submissions must be formalised in such a way as to inspire transparency.

Tax disputes in court

If the tax subject fails to succeed before the financial administration and the decision of the financial administration becomes final and enforceable, the tax subject may apply to the court with a so-called “tax appeal”. administrative action. In court proceedings, the taxpayer must be represented by a lawyer.

In the action, the taxpayer may request the court to postpone the enforceability of the decision of the financial administration in order to avoid enforcement proceedings before the court decides on the merits of the case. Such a tax dispute can be brought before the European Court of Human Rights.

It is in court proceedings that the aforementioned authenticity of the taxpayer’s conduct before the tax audit as well as during the individual tax proceedings significantly helps. The application (or cassation complaint) is most often based on a proven factual situation and highlights procedural and/or substantive aspects of the issues in dispute. Especially when explaining the substantive ones, the lawyer must proceed with caution. The submission must not be ‘overcomplicated’, unclear or inconsistent. It is also important that the lawyer knows and understands the economic side of the matter (i.e. taxes and accounting).

Under Slovak tax law, not every illegal tax optimisation fulfils the elements of one of the tax offences. Similarly to the identification of what is and what is not lawful in reducing tax or levy liability, the boundaries between criminal and administrative law supervision (Tax optimisation – domestic and foreign options) in the commission of tax offences are not clearly delineated.

Unfortunately, Slovak tax law does not know of many cases where courts or prosecutors have looked in detail at identifying more precise boundaries. From a business point of view, it is not at all comfortable not to be able to foresee the penalty for a tax offence committed. In this context, imprisonment (in conjunction with the penalty of forfeiture of property) is certainly the most serious interference with human integrity.

The case of KTAG Andreja Kiskis a case in which a critical part of Slovak entrepreneurs can see themselves. From the perspective of the requirements of the rule of law, it is not so much the fact that the case may have been a criminal offence of tax and insurance fraud that is problematic, but that the previous practice of tax administrators and law enforcement authorities has not in any way suggested that the criminal threshold has been pushed to this level. The latter affects a huge number of entrepreneurs who are thus ultimately exposed to the potential arbitrariness of the State.

We provide our clients with comprehensive tax advisory and tax optimization services (Tax optimization – domestic and foreign options). This includes, in addition to technical advice, legal analysis with an emphasis on the analysis of potential criminal risks.

These services are used by clients as standard in the following business process situations:

Example 1: A firm makes a profit. However, it does not pay the profit to the shareholder as a dividend, but gives it to the shareholder as a gift and thus avoids dividend tax. The legislation does not formally prohibit such action. We can consider it as:

Example 2: A well-known athlete moves to Monaco and becomes a Monegasque tax resident. However, he spends a large part of the year in Slovakia for various marketing events, sleeping in his Bratislava apartment or in hotels. If he does not pay taxes on his worldwide income in Slovakia, it is

Example 3: An entrepreneur has bought a family car on which he has deducted 100% of the VAT and treats 100% of the depreciation of the car as a tax expense. However, he uses the car exclusively for family transfers. This is

Example 4: An entrepreneur owns two companies. Before the end of the calendar year, preliminary results showed that one company was expected to make a profit of 1 000 and the other a loss of 500. Therefore, the entrepreneur decided to invoice 400 from the loss-making company to the profitable company for marketing services. He thus reduced his tax liability. This is

Example 5: An entrepreneur has set up a company on a Caribbean island with a 0% tax rate and from which he invoices his IT services to Slovak clients. However, the entrepreneur is mainly located in Slovakia when performing the services. These are:

In the area of employment of “contractors” we provide our clients with:

Highgate Group is a tax and accounting company and law firm. In one place our client can meet a payroll accountant as well as a lawyer who deals with employment law. On the basis of inquiries from our clients, we find that such a concept represents unquestionable added value not only for our clients, but also for our colleagues. They can thus seek professional support within the office.

Such a concept must undoubtedly also mean a more comfortable position for clients as recipients of payroll accounting services. In practice, we are witnessing situations where the accountant builds up legal information and awareness by searching for information on the Internet. This information may be misinterpreted and may not even agree with the current case law of the courts.

Our clients have the opportunity to use several templates of legal documents prepared by our law firm Highgate Group free of charge. Clients can use templates of employment contracts, termination agreements, cooperation agreements, etc.

Given the significant differences between standard employment and employment as a “trade”, this topic is relevant for almost every client. We look at it not only from a tax and levy point of view, but also from a legal point of view as well as with regard to social insurance benefits.

Suppose an employer has an employee who is paid a gross salary of EUR 2 000. Suppose they agree that the employee will set up a business and invoice the employer for his work, with aninvoice amount of EUR 2 000.

Suppose:

What are the tax and levy implications for both legal forms? The table is based on the current tax and levy situation in force in the second half of 2021.

| Employee | Freelancer | |

|---|---|---|

| Gross wage | EUR 2 000 | – |

| Employer costs | EUR 2 704 | EUR 2 000 |

| Health levies | 268 EUR | 76 EUR |

| Social contributions | 704 EUR | 181 EUR |

| Income tax | 211 EUR | 15 EUR |

| Net amount | EUR 1 521 | 1 728 EUR |

| Employer’s tax shield | 568 EUR | 420 EUR |

| Employer costs | 2 136 EUR | 1 580 EUR |

The financial differences between the two forms of ’employment’ are thus significant not only from the employer’s point of view, but also from the ’employee’s’ point of view. However, if the employee as a sole trader is in the so-called. levy holidays, the financial difference would be even more significant:

| Employee | Freelancer | |

|---|---|---|

| Gross wage | EUR 2 000 | – |

| Employer costs | EUR 2 704 | EUR 2 000 |

| Health levies | 268 EUR | 76 EUR |

| Social contributions | 704 EUR | 0 EUR |

| Income tax | 211 EUR | 52 EUR |

| Net amount | EUR 1 521 | EUR 1 872 |

| Employer’s tax shield | 568 EUR | 420 EUR |

| Employer costs | 2 136 EUR | 1 580 EUR |

However, a completely different tax-tax situation arises if the contractor cooperates with the company through its legal entity. In such a case, there are other aspects that come into play that can significantly adjust the resulting savings figure.

It is not possible to look at the benefits of ‘trade’ employment in isolation through the lens of the above tables alone. The complex picture is also completed by the effect onsocial insurance benefits , the amount of which varies depending on a number of circumstances, including the legal form under which the individual carries out gainful employment.

The situation is also different for social security benefits for contractors who provide their services through a legal person.

The basic condition for entitlement to maternity pay is that the person has been insured for at least 270 days in the last two years before giving birth. If the sole trader is in the so-called. is not paying social security contributions as a voluntary insured person, he or she may not be entitled to maternity pay. The amount of the maternity allowance is normally 75% of the so-called. the daily assessment base. The daily assessment base is derived from the average of the assessment bases in the so-called. crucial period. The decisive period varies depending on the circumstances of the case. To simplify, the amount of maternity pay for a self-employed person depends on how much and when the self-employed person contributed to social insurance. However, it is precisely in the case of maternity allowance for sole traders that the Social Insurance Act allows for flexibility to reach a situation where the sole trader receives the maximum maternity allowance. The maximum maternity allowance for 31-day months is slowly approaching EUR 2 000 each year. For more information, please arrange personal consultation with Peter Varga. Our accounting clients enjoy a 50% discount.

Generally, a tradesperson may be found unfit for work in the event of illness, accident or isolation/quarantine. The standard amount of sickness benefit is based on the tradesman’s social insurance contributions as well as the type of sickness absence (the amount may be different for pandemic sickness absence).

If the self-employed person meets the conditions for sickness benefit (e.g. he/she is a social security contributor or is in the so-called protection period), the amount of sickness benefit is similar to that for employees, i. e.:

The amount of the daily assessment depends on a number of factors. However, in general, sole traders using flat-rate expenses pay social contributions on lower assessment bases. This also has an impact on the calculation of the daily assessment base. It should also be taken into account that a self-employed person cannot estimate the amount of sickness benefit in advance to the same extent as he or she can do for maternity pay.

Nursing care became an important social supplement during the pandemic and school closures. It helped not only the employees/employers but also the employers themselves in terms of cash-flow to get through the difficult pandemic period of a suspended economy.

A self-employed person is normally entitled to sick pay as long as he or she pays social security contributions or is in the so-called. the protection period. The amount of the sickness benefit also depends on the daily assessment base, which is based on the contributions of the self-employed person to the social system in the so-called. crucial period. The amount of the sickness allowance is 55 % of the daily assessment calculated in this way. Thus, similarly to sickness benefit, the amount of sickness benefit for a sole trader is affected by the lower contribution obligation of sole traders compared to employees.

Although pensions are an abstract topic for many of our clients’ contractors, some of them are still interested in analysing the effects of converting to a trade in terms of future pension income. For pensions, the merit principle is normally applied – the more the insured person contributes to the social system, the higher the pension will be. However, this merit-based system is influenced by a social element, which is mainly represented by pension ceilings, the coefficient for higher pensions as well as the institution of the minimum pension.

For example, if the conversion from employee to sole trader means a lower pension of, say, €200, then with a 15-year pension the total amount is €36,000. And that is the relevant amount. Thus, when converting from employment to “contractors”, we also analyse this aspect for our clients on request.

A self-employed person is entitled to unemployment benefit only if he or she has paid voluntary unemployment insurance for at least two years in the four yearsbefore being registered as a jobseeker. A self-employed person must therefore have paid voluntary unemployment insurance to be eligible for this benefit.

The amount of the benefit is 50 % of the daily assessment base, which is based on the average of the assessment bases in the reference period. The reference period for unemployment benefit is different from that for maternity or sickness benefit, for example. The decisive period for establishing the daily assessment base is the two-year period preceding the date on which entitlement to unemployment benefit accrued.

The Schwarz system is not legal. In addition to the administrative sanction, it is also possible to fulfil the factual essence of one of the tax offences (in particular, tax and insurance premium evasion) in the case of a shvarc system. It is thus important, when setting up relationships with contractors or converting employees to contractors, to understand these steps as a project that also deserves consideration from a legal perspective. However, the aim is not only to minimise the risks associated with state sanctions, but also to set up contractual relations with contractors in such a way that the company is protected (for example, in relation to IP rights).

The case law is relatively diverse. A great inspiration should be sought in the Czech judicial practice, which has produced not only the term “shvarcsystem” but also a relatively extensive system of court decisions that help us in setting up defensible legal and tax-tax frameworks for employment “on a trade”. A partly different tax-tax situation arises if the contractor cooperates with the company through its legal entity.

We mainly provide the following services to our clients:

An offshore company is not to be understood as a company incorporated and existing in the jurisdiction of one of the Caribbean islands. For example, a critical part of Czech holding companies, which until recently were often set up by Slovak tax advisors in order to avoid capital gains taxation in Slovakia in the event of a successful EXIT, can be considered offshore companies. Even the recent sale of a well-known Slovak IT company was made through an offshore company. This was the Austrian holding company in this case. An offshore company thus does not only include companies from the so-called. tax havens that have been set up for the purpose of reducing the tax liability of the entrepreneur.

An offshore company is any company that is not located in the country of the founder or in the country in which the functions and risks associated with the income generated by the offshore company are actually carried out. An offshore company can thus also be located in the Czech Republic as well as in the British Virgin Islands. Offshore companies are also set up to achieve a degree of anonymity. In the recent past, it was common to hide assets through offshore companies with the legitimate aim of protecting them from various vested interests or violent structures. In South America, but also in Russia or Ukraine, it is still relatively common today for many businessmen to conceal their property in order to protect their lives and the lives of their family members. The disadvantages of property transparency are also experienced by many entrepreneurs in Slovakia thanks to public access to company accounts.

There are relatively many cases where part of the assignment from our client was also to achieve greater anonymity of his property disposition. The reasons may be different. From those illegitimate motives mainly related to criminal activities, it is also the need to protect the entrepreneur and his family from the attention or unreasonable demands of his business partners or employees. Offshore companies are also set up with the intention of avoiding administrative or regulatory restrictions.

In Slovakia, for example, it happens relatively often that the commercial register does not function as the law commands. Filings are also delayed for unreasonably long periods of time, creating a legitimate demand for company formation in other countries. However, does this legitimise the use of a favourable tax regime abroad? Similarly for regulation. If Slovak or European legislation allows entrepreneurs to do business in certain areas (e.g.: securities trader or collective investment fund) only with regulatory difficulties, entrepreneurs look for more flexible offshore solutions.

Slovakia is a small country, which naturally does not have the professional infrastructure and ambition to create a full-fledged legislative framework for cryptocurrencies and related business.

The result is a legally uncertain environment that is uncomfortable, especially for larger projects. This is mainly due to the lack of predictability of the decision-making activities of the relevant Slovak authorities. That is why several Slovak projects in the field of cryptocurrencies and blockchain are considering moving their legal presence abroad. In that case, they create offshore companies.

Is it legal?

Can the state interfere with this freedom and force entrepreneurs to tax profits from abroad in Slovakia?

The establishment of an offshore company in any tax haven is not in itself illegal. However, its subsequent use may become illegal. In practice, fictitious back-to-back supplies of services from tax havens via the Netherlands or the UK to a Slovak company are still relatively common. The entrepreneur is thus able to shift profits from the 21% tax rate bracket (Slovakia) to the 0% tax rate bracket (tax haven).

On the other hand, there are situations where the use of a company based in a 0% tax country may be perfectly legal and legitimate. The fact that a country does not tax corporate profits cannot in itself be problematic.

As can be seen, for example, in the subservices Patent Box and optimization for IT and development companies or Supercomputing for research and development, a 0% effective rate is relatively easy for a taxpayer to achieve even in Slovakia.

However, in a given case, it is necessary to use such an offshore company for legitimate reasons (e.g.: PR, investor’s request, better legal environment, etc.).

Slovakia has gradually adopted a number of statutory amendments to discourage Slovak entrepreneurs from illegitimate use of foreign offshore companies, primarily for tax avoidance purposes. For example :

CFC rules for individuals

The purpose of the rules is to ensure that the individual behind a foreign offshore company taxes the profits of that foreign offshore company. You can see more about this topic, for example, in the video “Is it even worth having an offshore company today? Ak áno, komu a kedy?“. Peter Varga’s criticism of these rules can be found in the article My comments to the MoF (CFC rules for individuals).

CFC rules for legal entities

Probably many taxpayers are completely unaware of the existence of this institute. The purpose of these rules is to ensure that the profits of foreign offshore companies are taxed by a related Slovak company, provided that the involvement of such a foreign offshore company resulted from one or more actions that are not genuine or were carried out for the purpose of obtaining a tax advantage.

35% tax

Certain payments made by a Slovak company abroad are subject to 35% withholding tax in Slovakia. On the other hand, certain dividends, liquidation proceeds or distributions are subject to 35% tax for the Slovak recipient in Slovakia. This is why it is nowadays problematic to “just” use, for example, a company established in the United Arab Emirates.

The place of the actual wiring

Based on the analysis of the place of the actual management of the company, the tax administrator is able to attribute Slovak tax residency to the foreign company despite the fact that the company is legally established and existing under a different legal order.

Final beneficiary

When applying withholding taxes, the tax administrator may check whether the Slovak taxpayer has investigated who is the final recipient of the income paid. The aim is to prevent the use of shell holding companies or other intermediaries.

Transfer pricing

In Slovakia, the perception of transfer pricing is undersized. The OECD Transfer Pricing Directive provides for its use even in situations where the taxpayer would not normally expect it. These include, for example, various internal reorganisations and the transfer of activities from one company to another. Indeed, such activities should be taxed.

Many more

In addition to other technical provisions, laws as well as case law, it is also familiar with substantive instruments. These are different concepts of substantive fairness or abuse of discretion under which a tax administrator may, in certain circumstances, take action against a structure that in no way formally contradicts the language of the tax code.

The analysis of the possibility of using an offshore company in a particular environment for a particular client should not only include tax and accounting elements. It is also necessary to look at the structure from a legal and practical point of view.

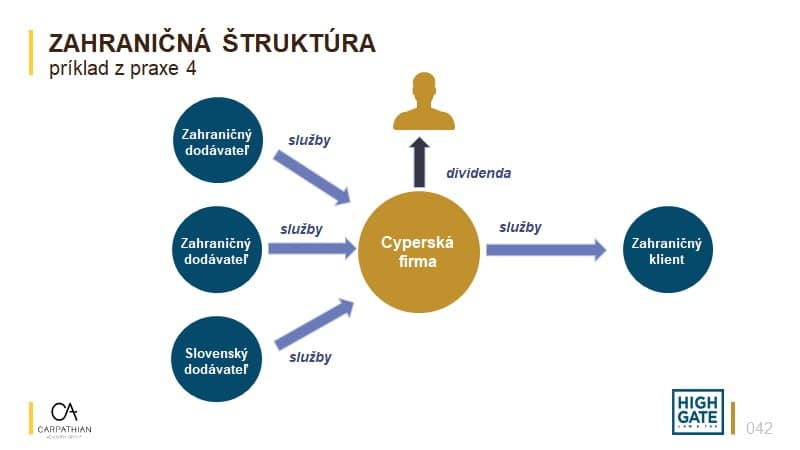

Suppose a business wants to take advantage of the tax exemption on the gain from the sale of shares or business interests in Cyprus. If an entrepreneur does not want to invest in a relevant advisor, he can make do with the Internet and his Slovak accountant. He finds out on the internet that Cyprus does not tax these profits by default, he finds a company that will set up a Cypriot company and provide him with a registered office, and a Slovak accountant approves it.

However, if he involves a relevant tax adviser in this structure, he will find that this type of tax optimisation has a broader dimension. For example, the following questions arise:

Counsel brings to the whole context the necessary legal dimension in situations where the written law does not give a clear answer. When interpreting, it uses case law, analysis of various interpretations of law (teleological, grammatical, historical, etc.) as well as philosophy and theory of law, which are necessary to reach in unclear situations. For example, the following topics may be covered:

In addition, you also need to have relevant practical experience with tax optimisation. For example, the following aspects may also be involved:

VAT audits form the most extensive area of our representation in tax proceedings. In fact, VAT audits occur much more frequently than income tax audits (e.g. in connection with illegal tax optimizations). VAT is the main source of revenue for public budgets in Slovakia. It is the most profitable tax and only the income from social levies is more significant for the state. If we analyse the period of the last 10 years (cash methodology), VAT has on average a 44% share in the total tax revenues of the state. By comparison, corporate income tax only accounts for 18% of the state’s revenue.

The second reason for which it is possible to understand why the state places so much emphasis on VAT is the problem of the so called “VAT”. VAT tax loopholes. This loophole represents a kind of estimate of VAT evasion, as VAT ranks the state among the highest risk taxes in terms of tax evasion. The peak of inefficiency of VAT collection in Slovakia was in 2012, when the VAT tax gap reached 40% of the VAT collection potential. Today, the gap is much smaller, but still relevant. This is a relatively significant step forward, and this is also the reason why the state has decided to relax some of the institutes of the VAT Act (for example, the abolition of the mandatory security).

While one can generally agree with the dynamism and emphasis that the state has placed on VAT collection and related tax controls in recent years, this approach has its limits. And it seems that in many cases these limits have been exceeded, which should not be the case in a state governed by the rule of law. And it is up to the courts to be able to identify those limits reliably and consistently, in order to cultivate the much-needed legal certainty in the business environment. And it is our job as tax attorneys and tax advisors to sensibly inform the courts of these oversights by the tax authorities.

You can also find interesting facts from tax audits in our media outputs or articles or seminars. We often talk about this at our conferences (click here to link to conferences). However, we pay particular attention to interviews for Trend (Advocate: tax audits are often purposeful and absurd) or ( You should have known! How taxpayers hunt for healthy companies ) but the Economic Newspaper (Are tax audits still a problem even for honest companies?)

Law & Tax

Tomas Demo

tomas.demo@hg.amcef.com

Accounting

Peter Šopinec

peter.sopinec@hg.amcef.com

Crypto

Peter Varga

peter.varga@hg.amcef.com

Highgate Law & Tax

Nivy Tower, Mlynské Nivy 5,

821 09 Bratislava

Slovak Republic

Highgate Accounting

Nivy Tower, Mlynské Nivy 5,

821 09 Bratislava

Slovak Republic

E-mail

info@hg.amcef.com

Are you interested in the services of Highgate

Group? Get in touch at

info@hg.amcef.com

Careers

Interested in working for Highgate

Group? Get in touch at

info@hg.amcef.com