As is already customary, with the New Year comes the entry into force of many amendments to laws. The year 2023 is no exception, which brings with it the entry into force of the amendment to Act No. 580/2004 Coll. On Health Insurance and on Amendments to the Act, which was adopted on 22.12.2022 and subsequently published in the Collection of Laws of the Slovak Republic on 30.12.2022, and entered into force on 01.01.2023. Among other things, the above means that it will apply to income for the month of January 2023 paid in February 2023 and not to income for the month of December 2022 paid in January 2023.

The amendment introduces the so-called minimum employee health levy. The previous legislation did not provide for such a thing . Do účinnosti tejto novely the employee paid the insurance premiums on the gross salary or remuneration earned in the relevant month. On that basis, he was provided with general health insurance, often literally “for a few euros”. For example, under the old system, if an employee earned a gross salary of EUR 100 in a given month, he also paid a total of EUR 14,00 in insurance premiums on that amount, namely EUR 4 for the employee and EUR 10 for the employer.

The same was true for managing directors, if the managing director had a monthly remuneration of EUR 10, EUR 1.40 per month was paid to the health insurance company for him, while he was fully covered by public health insurance.

This fact often led in practice to the conclusion of many speculative employment contracts.

This was because if a person was registered as voluntarily unemployed, he or she would be obliged to pay insurance premiums at the level of the minimum levy, which for 2022 was EUR 79,31 (currently already EUR 84,77 for 2023).

After all, it was precisely the desire to prevent speculative remuneration, speculative employment and the avoidance of levy obligations that led the legislator to adopt the aforementioned amendment.

At first gl ance, it may seem that the amendment will affect only employees or persons who receive remuneration from dependent activities with income below the minimum subsistence level, which is EUR 234.42 as of 01.01.2023. However, it will also affect employees with a monthly income higher than EUR 234.42, up to EUR 328.00 per month if they claim a deductible in health insurance.

As we have already indirectly outlined, this will also affect members of statutory bodies (e.g. managing directors who are also owners of the company) whose remuneration is below the current minimum subsistence level, i.e. j. less than EUR 234,42.

According to the amendment, the insurance premiums together with the advance payment for insurance premiums must be at least the amount that the employee would pay together with the employer if the employee’s salary were equal to the minimum subsistence level for a single natural person, i.e. j. the aforementioned EUR 234,42.

The Health Insurance Act, in turn, provides that the premium rate for the employee is 4% of the assessment base and for the employer 10% of the employee’s assessment base.

Taking into account the condition that the minimum health levy, as we have mentioned above, is calculated on a minimum of EUR 234.42, a simple calculation leads to the conclusion that the minimum health levy is EUR 32.81 per month.

However, the employee’s minimum advance shall be reduced by the proportionate part attributable to the number of calendar days during which the employee has been employed:

Example:

The person was registered as an employee with the health insurance company during January 2023, but at the same time, between 01.01.2023 and 25.01.2023, the person was incapable of work and received income compensation from the employer and sickness benefit from the Social Insurance Institution. As a result, the person was not also insured by the State for 5 days. Therefore, the calculation will be as follows:

In this case, the employee’s minimum advance payment will be EUR 5.29 for the month of January.

These are cases where the calculated health levy would not reach the required minimum amount and therefore the difference would have to be made up. Once the employee’s health levy comes out below EUR 32,81, the employee is obliged to make up the levy up to that amount. This also implies that the employer’s levy burden does not change and any additional payment up to the amount of the minimum advance payment is paid in full by the employee.

For the sake of simplicity, let us give the following examples (for the purposes of the calculations, we assume that the employees do not use any deduction):

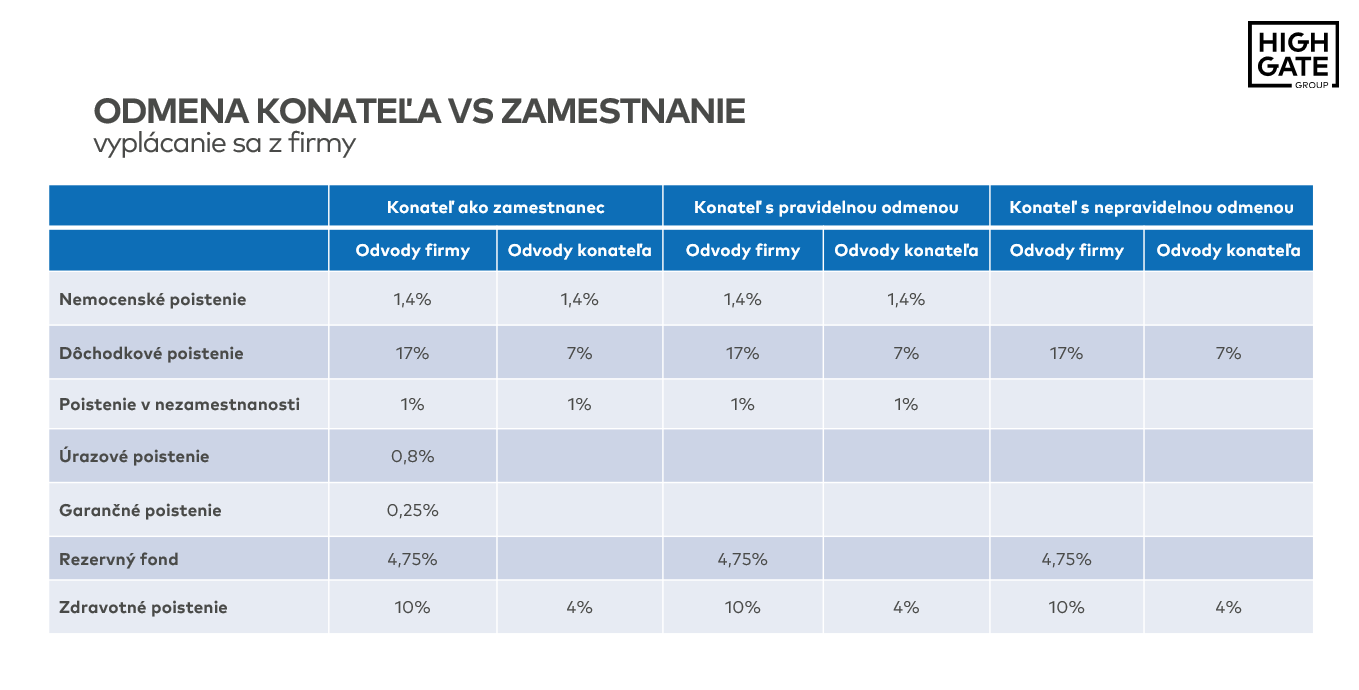

As we have already mentioned, the amendment will also affect directors with a symbolic remuneration, below the minimum subsistence level. This is mainly because the managing director of a company who pays himself remuneration is also considered an employee, as this is a dependent activity.

Despite the introduction of minimum health levies, such income optimisation will still be to some extent advantageous for statutory bodies. However, it may also not be the most efficient solution because of the various tax-insurance benefits, which include social insurance benefits or tax bonuses. If executives continue to pay themselves less than the living wage despite legislative changes, they could “overpay” on health insurance prepayments .

In order to avoid only “topping up” health levies, one solution could be to increase the executive’ s remuneration to the subsistence level, or even a little higher. As a consequence, although directors would have higher tax and social security contributions, they would also benefit from the social security system in the long run.

Managing directors who decide to increase their remuneration to the living wage level can save approximately EUR 40.00 per year on their regular remuneration by doing so.

If the directors increase their remuneration to, for example, EUR 400.00 per month, they would pay an extra EUR 200.00 per year to the health insurance company. Although the amount of their income would also affect the amount of their social security contributions, they would also be entitled to a minimum pension if other conditions were met. The amount of social contributions calculated on the basis of income is, among other things, also responsible for a higher tax bonus, affects sickness benefits and other benefits paid under social insurance.

Another possible alternative is for the managing directors to consider moving to an employment relationship with a monthly salary of EUR 329.00. In this case, they would be able to save approximately EUR 36,00 per year.

More of our comments on the issue can also be found in interviews for Trend(From the new year, health levies must be paid also by statutory officers with a symbolic salary), Hospodárske noviny (

The employee’s minimum advance does not apply to an employee who is:

In short, this means that if the employee was also insured by the state during the whole month, the minimum employee health insurance contribution does not apply.

However, if the employee was also insured by the State for only part of the month, as we have already mentioned earlier in this article, the amount of the minimum advance payment will be reduced by an aliquot amount.

In addition to the above, minimum health contributions do not apply to persons who do not receive any wages or remuneration, such as a contract worker who has no wages in a particular month.

If you are interested in this topic, please do not hesitate to contact us.

Law & Tax

Tomas Demo

tomas.demo@hg.amcef.com

Accounting

Peter Šopinec

peter.sopinec@hg.amcef.com

Crypto

Peter Varga

peter.varga@hg.amcef.com

Highgate Law & Tax

Nivy Tower, Mlynské Nivy 5,

821 09 Bratislava

Slovak Republic

Highgate Accounting

Nivy Tower, Mlynské Nivy 5,

821 09 Bratislava

Slovak Republic

E-mail

info@hg.amcef.com

Are you interested in the services of Highgate

Group? Get in touch at

info@hg.amcef.com

Careers

Interested in working for Highgate

Group? Get in touch at

info@hg.amcef.com