This analysis deals with the issue of illegal employment in the form of a disguised de facto employment relationship by another contract, i.e. the schvarcsystem.

In the early 90s. years, entrepreneur Miroslav Švarc founded the construction company Švarc s. r. o. The vision of many after the fall of the regime was clear and that was to stand on their own feet and make money. In this case it was no different, Švarc decided to employ freelancers very soon after the establishment of the company, in this way he did not have to pay compulsory contributions and he could terminate the employment relationship at any time. The attraction for people was the increased wages compared to what they would have had if they had been employed. The company quickly began to make billions in sales and did so well that it became a sponsor of the Benešov football club. Thanks to Mr. Švarc’s cash injections, the football club made it all the way to the first league.

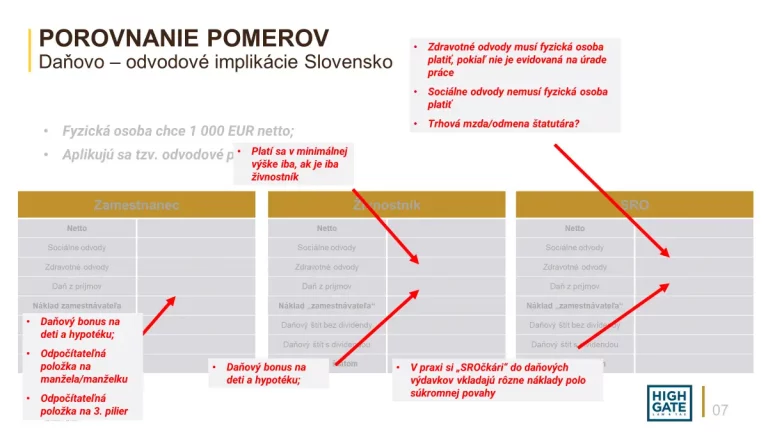

It is similarly attractive in Slovakia today (below is part of a slide from a training session on “Employing” freelancers – where is the limit?).

Legal, tax and levy details on the topic of the shvarcsystem can be found in the online training by Peter Varga “Employing” freelancers – where is the line?

At the time, no one knew that the name of the famous billionaire would soon become a byword for illegal employment. It wasn’t long before the state stopped liking that it was losing quite a lot money. A law was passed that officially banned the shvarcsystem. After the ban, Švarc’s life took a quick turn. He was first fined several times, then charged with embezzlement of social security benefits, and finally sentenced to three and a half years in prison for tax evasion.

At first glance, it would seem that this story was so intimidating that no one would want to risk it anymore, well the opposite became true. Nothing has changed by banning or convicting the father of the shvarcsystem. People are still trying to find ways to get around the ban and enjoy the benefits of doing so. And thanks to generous flat-rate spending, they are trying it today in Slovakia.

The Schwarcsystem has become a well-known term among people. It is regulated in particular by law č. 82/2005 Z. z.. which defines several types of illegal work, but primarily prohibits the classic shvarcsystem. It is understood by law as dependent work performed by an individual for an entrepreneur without an employment relationship or a state employment relationship existing between them. The prohibition of the shvarcsystem applies to both sides – to the person who works and to the recipient of this work.

The performance of work by a self-employed person for an entrepreneur cannot in all circumstances be subsumed under the definition of a shvarcsystem. The essence is that the characteristics of dependent work, which are found in Art. 2 of the Labour Code, under which it is the work performed:

If all of the above conditions are met, we are talking about a dependent activity that can be carried out exclusively in an employment relationship. Peter Varga talks more about this borderline also on the basis of the practice of state authorities in the online training “Employing” freelancers – where is the limit?

To begin with, the shvarcsystem is financially advantageous for both parties at first sight. The employer does not pay compulsory contributions, is relieved of administrative activities, costs related to the employment relationship and can terminate the relationship with the sole trader at any time. Peter Varga talks more about the financial benefits in the online training “Employing” freelancers – where is the line?

For example, for a sole trader, the advantages are:

The employee is always the weaker party in employment law, but by switching to the sole trader regime, he loses a number of benefits that he should enjoy in accordance with the Labour Code.

An example would be:

In addition, a self-employed person is entitled to lower social insurance benefits (maternity, pension, unemployment benefit, sick pay, maternity pay, etc.). More about these benefits in the training “Employing” freelancers – where is the limit?

The State is aware of the benefits of the shvarcsystem and therefore it is in its interest to carry out controls.

Control of illegal work and illegal employment, according to Act no. 82/2005 Coll. are carried out by the following inspection bodies:

In addition to these authorities, the shvarc system is also controlled by the administrative authorities for health and social insurance, as well as by the tax authorities.

Labour inspectorates have even created specialised units to combat illegal employment “Cobra“. Their sole task is to check whether illegal employment or illegal work is taking place in workplaces.

The entrepreneur for whom the illegal work is carried out can be punished relatively severely. The labour inspectorate can impose a fine up to EUR 200 000 (minimum EUR 2 000). Even a natural person acting as a statutory body can be penalised for illegal work, in which case he or she is liable for the entirety of his or her assets.

A fine may also be imposed on the de facto employee himself.

If an employer repeatedly violates the prohibition of illegal employment, this is considered a particularly serious violation that leads to the revocation of his trade licence.

Should the trade licence not be revoked, the employer will be sanctioned by not being able to receive subsidies, aids and grants from the state or EU funds and not being able to participate in public procurement for the next three years. Another sanction is registration in a central publicly accessible list of natural persons and legal entities that have violated the prohibition of illegal employment.

In this article, we are generally concerned only with the controls carried out pursuant to Act No. 82/2005 Coll. More detailed information on these controls, including the amount of fines, current practice, court proceedings as well as controls carried out by tax administrators can be found in the online training “Employing” freelancers – where is the limit?.

Below are some interesting decisions of Slovak and Czech courts on the issue of the shvarcsystem.

In one decision, the court addressed the question of whether a natural person in the position of a betting shop director may carry out this activity on the basis of a mandate contract or whether it is a disguised employment relationship.

The following facts were found during the inspection. A company operating a network of betting shops employed a betting shop manager under a mandate agreement. The exercise of the activities was varied as it involved setting up a new operation, i.e. providing premises and staffing for a betting office, later on after setting up, he gave reprimands to employees, cut wages, approved leave requests and proposed payment of 13. salaries. He was remunerated monthly for the performance of these activities on the basis of processed attendance.

The subject matter of the mandate agreement is the establishment of a particular business matter, but in this case it was the performance of incidental tasks under the employer’s instructions and orders with an overriding employment character. In its reasoning, the court referred to the standard rule of interpretation of commercial contracts. The basic criterion for evaluating the actual content of the contractual relationship is a proper evaluation of all the circumstances relating to the manifestation of the will of the contracting party, which can be ascertained from the actual conduct. If the parties behave differently from what an ordinary businessman would expect in a mandate contract, then their primary motive was not to enter into a mandate contract and their contractual relationship is simulated. In this case, it was a clear case of legal concealment, in which the court found in favour of the tax administrator.

Another decision concerned a dispute between a taxpayer and a tax administrator concerning the employment of a sole trader as a senior accountant through a mandate agreement.

The tax administrator looked at three main criteria in its assessment: the chief accountant worked at the company’s headquarters using company equipment (both hardware and software), he received a monthly remuneration for his work, and last but not least, it was a continuous exercise of activity. A mandate agreement is an undertaking by the mandator to establish a particular activity and not an undertaking to perform on a continuing basis, to which the court responded that this strict language interpretation would lead to repeated contracting for each individual matter. If a business matter is defined in a definite way, its implementation may consist in arranging for a single specific matter, and equally in arranging for a recurring activity, or in arranging for a permanent and recurring group of matters. The court further pointed out that the accountant was responsible for the accounts as a sole trader, not as an employee, and it was a secondary activity. Therefore, the court found that this was not a disguised act, but a common phenomenon of the so called. outsourcing, which aims to use external entities for activities that are not the company’s core business and would lead to an unnecessary time and financial burden.

Another decision concerned the employment of tradesmen carrying out construction work for an entrepreneur.

In the present case, the tax administrator did not hesitate to reclassify these activities as a dependent activity. This is because the work was carried out under the instructions of and on behalf of the employer, the builders did not incur any material costs in securing the result, they invoiced only the employer and it was a generic activity. The tax administrator assessed that the above sufficiently meets the definition of dependent work. However, the court stated in its decision that even the totality of all of the above cannot and does not lead to a legal conclusion that the work is dependent work. He went on to say that it is not dependent work if it is specialised work carried out only on a short-term or non-constant basis and where its performance is conditioned by factors largely independent of the employer (e.g. seasonal work, weather-dependent work, etc.). Failure to accept these facts would place an illegitimate burden on the private sphere. On the basis of the above, the competent court disagreed with the findings of the tax authorities and sided with the taxpayer.

Can the state (law enforcement agencies) view the shvarcsystem through a criminal lens? More information on this topic is provided by Peter Varga in the online training “Employing” freelancers – where is the line?. An interesting discussion among lawyers has also arisen on the legal forum https://www.lexforum.sk/545. As liability is in some situations also transferred to the statutory body – a natural person, the entrepreneur should be legally cautious when setting up the shvarcsystem. This is not only in the context of potential arbitrariness of the state, but also in the context of the current legal framework of illegal employment and tax fraud offences.

If you are interested in this topic, please do not hesitate to contact us.

Law & Tax

Tomas Demo

tomas.demo@hg.amcef.com

Accounting

Peter Šopinec

peter.sopinec@hg.amcef.com

Crypto

Peter Varga

peter.varga@hg.amcef.com

Highgate Law & Tax

Nivy Tower, Mlynské Nivy 5,

821 09 Bratislava

Slovak Republic

Highgate Accounting

Nivy Tower, Mlynské Nivy 5,

821 09 Bratislava

Slovak Republic

E-mail

info@hg.amcef.com

Are you interested in the services of Highgate

Group? Get in touch at

info@hg.amcef.com

Careers

Interested in working for Highgate

Group? Get in touch at

info@hg.amcef.com