More and more business companies are dealing with cryptocurrencies today. Some are buying them on the company because it is more tax-efficient in some cases, while others, for example, receive payment in cryptocurrencies for goods or services delivered. Either way, cryptocurrencies, or virtual currencies as they are nowadays (and incorrectly) referred to in legislation, represent a relatively difficult task for accountants. Although the Ministry of Finance of the Slovak Republic has issued a methodological instruction on the basic accounting treatment of cryptocurrencies, the economic and functional diversity of cryptocurrencies is advancing by leaps and bounds. Therefore, in practice, we encounter a number of questions and inconsistencies, which are addressed not only by clients, but also by accountants and tax advisors. This is natural, as the topic of cryptocurrencies is extremely complex and dynamic. We write about tax and accounting topics mainly on our crypto website, we speak at conferences, webinars or for the Association of Accountants of Slovakia and the Slovak Chamber of Tax Advisors, and we try to be active in the development of legislation (see our proposal for tax staking). Vo svetle vyššie uvedeného sme nižšie pripravili relatívne komplexnú praktickú pomôcku pri účtovaní o nákupe, predaji a darovaní kryptomien v obchodnej spoločnosti.

We draw on the following sources:

For the purposes of this publication, we consider the terms cryptocurrencies and virtual currencies (also abbreviated as “VMs“) to be identical terms.

The term ‘entity’ means a company or other entity accounted for in accordance with accounting procedures.

A micro-entity is an entity that meets at least two of the following conditions:

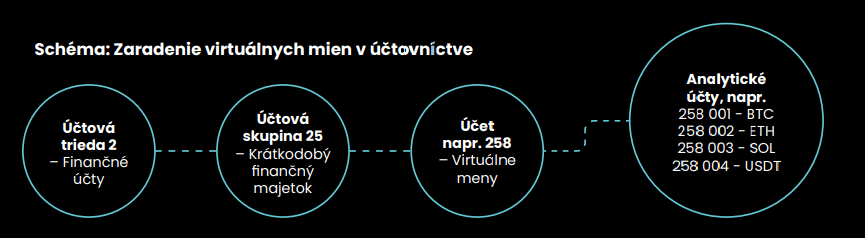

Virtual currency acquired for consideration and virtual currency acquired in exchange for another virtual currency are current financial assets.

The additions to and disposals of virtual currency shall be accounted for , for example, in account 258-Virtual currencies, or in another account in account group 25-Current financial assets that the entity establishes in its chart of accounts.

Analytical accounts shall be established on a virtual currency-by-virtual-currency basis.

Virtual currency shall be shown on line 68 in the balance sheet of the small and large entity and on line 23 in the balance sheet of the micro entity.

Virtual currency is measured at fair value at the date of the accounting event.

Fair value is measured (Section 25(1)(h) of the CGU):

The virtual currency is converted into euros at the date of the accounting event (§ 24 para. 10 of the CGU). The fair value of the virtual currency expressed in a foreign currency shall be translated into euro at the ECB/NBS exchange rate on the day preceding the date of the accounting event (§ 27(13) of the CGU).

A virtual currency is also measured at fair value by a micro-entity.

The fair value of a virtual currency is the market price at the date of the accounting event (e.g. the date of purchase or sale of the virtual currency) , as determined by the entity from the selected public market for the virtual currency.

An entity uses the same method of determining fair value for a given virtual currency during the accounting period.

As the virtual currency is converted to fair value at the date of acquisition, the resulting valuation differences are debited to account 568 – Other finance costs (if the price at which the virtual currency was acquired is greater than fair value) or credited to account 668 – Other finance income (if the price at which the virtual currency was acquired is less than fair value), depending on the nature of the valuation.

However, in the case of an exchange purchase, these revaluations to fair value should not arise as the exchange purchase is already at fair value. Rather, these revaluations relate to the situation where the virtual currency is acquired by purchasing in an individual trade (so-called P2P trades).

Fees… (more in the e-book we have prepared)

If you are interested in this topic, please do not hesitate to contact us.

Law & Tax

Tomas Demo

tomas.demo@hg.amcef.com

Accounting

Peter Šopinec

peter.sopinec@hg.amcef.com

Crypto

Peter Varga

peter.varga@hg.amcef.com

Highgate Law & Tax

Nivy Tower, Mlynské Nivy 5,

821 09 Bratislava

Slovak Republic

Highgate Accounting

Nivy Tower, Mlynské Nivy 5,

821 09 Bratislava

Slovak Republic

E-mail

info@hg.amcef.com

Are you interested in the services of Highgate

Group? Get in touch at

info@hg.amcef.com

Careers

Interested in working for Highgate

Group? Get in touch at

info@hg.amcef.com